The Year of the Insurance Platform: Property/Casualty Edition

21 June 2018

2018 is a critical year for insurance platforms gaining momentum. If successful, they will significantly change how insurance technology firms compete.

Key research questions

- What is a platform?

- Why should an insurance technology provider build one?

- What are the implications for insurers and technology firms?

Abstract

A January 2018 blog at celent.com was more in the nature of a hypothesis than a prediction. The blog, If 2017 Was the Year of Insurtech, Will 2018 be the Year of the Insurance Platform? was based on the observation that three leading technology providers were offering “platforms.”

It is worth paraphrasing a portion of that blog:

- Many platforms start out as a limited purpose website (e.g. searching the web, selling books, letting friends keep track of one another, or making it easier for a salesperson to keep track of leads and contacts). If it achieves that purpose in a very engaging and effective way (aka fast, fun, and easy), then that website starts drawing a lot of visitors or customers (creating network effects), and allowing the site sponsor to expand the site’s functionality, collect lots of data about those visitors and customers, and monetize that traffic and data.

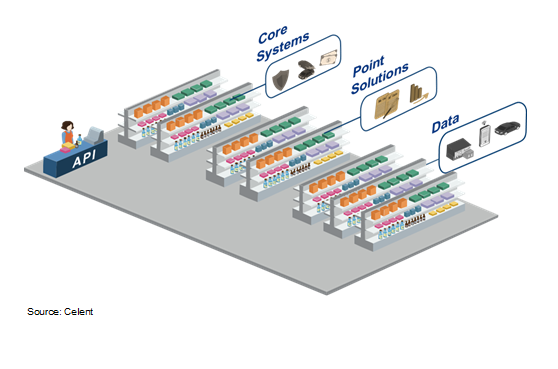

An insurance platform is a group of sites which provide insurers and other organizations access via APIs to a broad set of services, data, capabilities, and organizations, which are: typically cloud-based, designed to achieve scale through network effects, and monetized by the platform sponsor in various ways.

An Insurance Platform