Capital Markets Surveillance Vendor Landscape: The Next Wave in Trade and Communication Surveillance

The vendor ecosystem is undergoing transformation with new players entering, incumbent players ramping up their game, and partnerships and restructuring taking place.

Key research questions

- Why is surveillance technology becoming important?

- How is the surveillance vendor landscape evolving?

- How will capital markets surveillance solutions evolve?

Abstract

Analytics is reshaping capital markets surveillance.

This report presents the latest trends and innovation in multichannel surveillance technology through an analysis of 17 of the top vendor solutions.

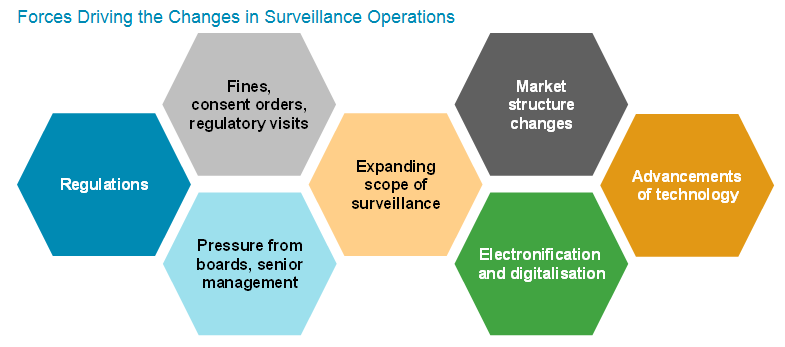

Regulations provide the biggest impetus for demand for automated surveillance solutions, as well as for enhancement of vendor solutions. Financial institutions are demanding new functionalities for sophisticated surveillance capabilities, as well as improvements in time to market and cost of ownership of surveillance solutions.

There is a heavy focus on analytics in general, and leveraging artificial intelligence and machine learning specifically, for enhancing the surveillance solutions across the board.

Improving cross-asset class surveillance is another focus area, both for exchange-traded and over the counter markets such as foreign exchange, commodities, fixed income, credit, and rates.

Enhancing the integration of communications in trade surveillance algorithms is a top priority for leading vendors.