CIO Priorities in Capital Markets Infrastructure: Technology Empowers New Models

Technology empowers new business and operating models for market infrastructure providers.

Key research questions

- What factors are driving changes in market infrastructure?

- How are market infrastructure providers using technology to support business strategies?

- How is technology spending evolving?

Abstract

Through 20 qualitative interviews with leading market infrastructure providers in the world, Celent has been able to draw the state of their technology transformation, what drives their investments, how they manage the change, and what their concerns are in terms of technology innovation.

Market infrastructure (MI) providers in capital markets are in the midst of radical transformation. Regulatory and market structure changes continue to reshape the MI landscape, but their response to altering client behavior, business models, and competitive dynamics is enabled by technology development and transformation.

Most MIs are working on major technology modernization and rationalization projects to support growing volumes, comply with the latest regulations, optimize operations, and offer unified client experiences. A big focus is on achieving international standards and practices, especially among developing market players. From 10% to 50% of MIs’ IT budgets goes to changing the legacy technology and innovating, versus 90% to 50% for the maintenance of systems. The bigger the player, the more already amortized are the maintenance costs and thus the split tends to be closer to 50/50.

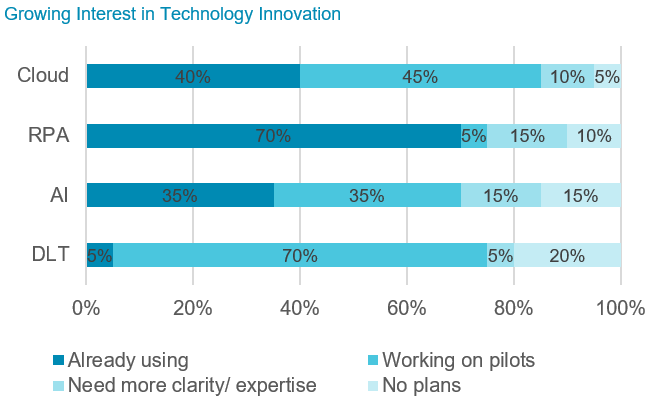

There is tremendous interest in adopting new technology such as cloud, AI, machine learning (ML), and distributed ledger technology (DLT) because they can help develop innovative solutions, new business models, and contribute to significant operational improvements. New solutions are being developed with of one the new technologies (open architecture, cloud, and/or application programming interfaces), or at least with provisions to easily incorporate them in the future, by 95% of market infrastructures surveyed.